TaxAct Calculator 2018

TaxAct Calculator 2018 - tag: TaxAct USA, TaxAct UK, TaxAct AUS, TaxAct Canada, TaxAct EU, TaxAct refund calculator 2018, TaxAct tax calculator 2018, TaxAct calculator 2019, TaxAct calculator, TaxAct calculator 2020, TaxAct calculator for 2018, TaxAct refund calculator 2019, TaxAct refund calculator, TaxAct refund calculator 2020, TaxAct refund estimator, TaxAct 2018 tax calculator, TaxAct income tax calculator, TaxAct 2019 calculator, TaxAct 2019 tax calculator, 2018 tax refund calculator TaxAct. TaxAct Calculator 2018

TaxAct Professional Edition is appropriate for little to medium-sized firms and assessment preparers that handle a high number of 1040 structures. Recently equipped towards people, TaxAct Professional presently offers an assortment of alternatives for both 1040 and business structure readiness and recording. TaxAct is likewise accessible for people hoping to set up their own duties.

TaxAct Professional can be introduced on a work area or workstation PCs, just as on a system, where the item can be shared. Clients can likewise pick to introduce the item as an online system, however, the online choice is just accessible in the Enterprise versions of TaxAct Professional. Those utilizing TaxAct Professional in earlier years can import information from the earlier year or import information from another duty consistent application. TaxAct Calculator 2018

Once TaxAct Professional is introduced, the Setup Wizard guides clients through the whole procedure of entering practice, preparer, customer, and security data just as general inclinations. For those introducing TaxAct Professional on a nearby system, partners should be welcome to utilize the application so as to access it. Clients can get to any customer from the Client Manager menu and can decide to print customer coordinators for new customers with the customer coordinator portfolio including a spreadsheet, individual data for every customer, just as salary, conclusion, and installment data. TaxAct Professional likewise incorporates TaxTutor, which educates clients about duty law changes, and the item offers a What-If situation for getting ready different assessment alternatives for customers.

For firms that solitary record 1040 structures, either the 1040 Bundle or the 1040 Enterprise Bundle are appropriate choices, which incorporate both government and state 1040 documenting, while those that procedure business structures will need to take a gander at different groups, which record 1041, 1065, 1120, 1120S, and 990 administrative structures, and 1041, 1065, 1120, and 1120S state petitioning for all states.

All TaxAct Bundles incorporate boundless e-documenting ability, with each of the four packs offering boundless 1040 e-recording capacity, while the Complete Bundle and the Complete Enterprise Bundle offering both boundless 1040 e-recording and boundless business structure e-recording ability.

TaxAct Calculator 2018

TaxAct Professional incorporates with the discretionary Client Xchange entrance, that permits firms and customers to trade archives by means of the entryway from any gadget. The Client Xchange underpins a boundless number of customers and archives and effectively handles an assortment of record types including Microsoft Excel, Word, and CSV documents, PDFs, and receipt pictures. Clients basically welcome their customers to pursue the application, with the capacity to share reports once the customer is enrolled.

The Professional Enterprise Editions of TaxAct Professional incorporates a Document Manager highlight that permits clients to spare everything from tax documents and their supporting monetary records to notes and other customer correspondence. All reports are safely scrambled, and clients can without much of stretch access any record through the Document Manager include. Discretionary distributed storage is likewise accessible, so firms can safely store every firm datum on the cloud, with simple access from anyplace with an Internet association.

Bookkeeping firms would now be able to cooperate with ProAdvance from TaxAct, which offers access to an assortment of outsider business assets structured explicitly for the expert bookkeeping office. These assets incorporate installment acknowledgment arrangements, money related and riches the board administrations, review and data fraud help, customer finance alternatives, practice the executive's usefulness, and independent venture loaning choices. TaxAct Professional additionally offers a development discount alternative for firm customers, with endorsing gave by Republic Bank and Trust. As of now, TaxAct Professional doesn't offer a mix with any assessment look into applications.

TaxAct Calculator 2018

TaxAct Professional offers strong framework help, with clients ready to get to the help page from anyplace in the application. Bolster choices incorporate a Getting Started highlight, a Setup Guide, and access to all assistance subjects. The assistance highlight is totally accessible, so clients can simply enter a pursuit term or expression to get to help for that specific subject. Both item and duty bolster alternatives are accessible by means of telephone or email, with expanded help accessible during charge season. All item support is remembered for the expense of the product. TaxAct Calculator 2018

TaxAct Calculator

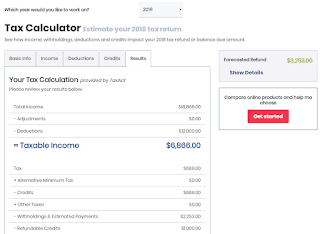

- The Tax Calculator* provides the ability to perform What-If scenarios in your current year's TaxAct® return for the current or future years. You can project your earnings and expenses into the following years and then make estimated changes to the information to determine your tax liability for the current or upcoming years based on those changes.

Online Navigation Instructions:

- Log into your TaxAct Online return

- Click Next Year. On smaller devices, click the menu icon in the upper left-hand corner, then select Next Year

- Click Continue or No until you reach the screen titled Tax Calculator

- Click the button Tax Calculator to enter the information and/or print the report.

- Another option for estimating the current year return would be to utilize the Tax Calculator on the TaxAct website. From the TaxAct website, click Tax Info in the top center of the screen. On the website Tax Information for When You Need It Most, click the link Tax Tools & Calculators. From there click the link Tax Calculator and proceed through the screens to enter the information. On the final screen, titled Your 2018 Tax Calculation, you will be able to view a summary of the results based on your entries. From there you can also click the green link titled Start your return for Free! to start a return using the TaxAct program.

TaxAct 2018 Terms

Tax Reform

- Officially known as the Tax Cuts and Jobs Act, the 2018 tax reform included many adjustments to tax law and how taxpayers are affected. Find up-to-date information on tax reform and answers to commonly asked questions here.

Deductions

- The purpose of tax deductions is to decrease your taxable income, which then decreases the amount of taxes you need to pay to the federal government. To help you reduce your taxable income, we aggregated a huge list of deductions many people often overlook or aren’t sure how to use them to their advantage.

Adjustable Gross Income (AGI)

- For tax purposes, your adjusted gross income or AGI is essentially your total or gross income minus eligible deductions. You can use our AGI calculator to estimate your adjusted gross income using the most common income and deductions for US taxpayers.

Tax Brackets

- Your tax bracket shows you the tax rate that you will pay for each portion of your income. For example, if you are a single person, the lowest possible tax rate of 10 percent is applied to the first $9,525 of your income in 2018. The next portion of your income is taxed at the next tax bracket of 12 percent. That continues for each tax bracket up to the top of your taxable income. Find yours with our helpful tax bracket calculator.

Taxable Income

- Most income is taxable, whether you earn it or are paid as a return on your investment. Also, you generally have to pay tax on income when you sell something for more than your basis (usually the amount you paid for something). If a type of income is taxable, it doesn't matter if you receive payment in cash, by check or electronic payment, or in the form of goods or services. You still pay tax on it.

- Certain types of income are excluded from tax. This generally includes income you or someone else has already paid tax on, or income from special situations, such as combat pay.

Filing Status

- Your tax filing status makes a big difference in your tax return when you file. Many people simply choose the status they believe best fits their personal situation, but in some cases, you may have more than one option. At that point, it’s up to you to pick the status that offers you the most tax advantages. Filing status options are:

- Head of Household

- Married Filing Jointly

- Married Filing Separately

- Single

- Qualified Widow or Widower

Learn everything you need to know about how filing status impacts your tax return and refund here.

Tax Credits

- Credits differ from deductions and exemptions because credits reduce your tax bill directly. After calculating your total taxes, you can subtract any credits for which you qualify. Some credits address social concerns for taxpayers, like The Child Tax Credit, and others can influence behavior, like education credits that help with the costs of continuing your education.

- There are numerous credits available for a wide range of causes, and all reduce your tax liability dollar for dollar. That means a $1,000 tax credit reduces your tax bill by $1,000. Reviewing all the options may be time-consuming, but could also prove to be profitable.

Some major tax credits are:

- Foreign tax credit

- Credit for child and dependent care expenses

- Education credits

- Retirement savings contribution credit (Saver's Credit)

- Child tax credit

- Residential energy credits

Exemptions

- Exemptions are portions of your personal or family income that are ‘exempt’ from taxation. The Internal Revenue Code allows taxpayers to claim exemptions that reduce their taxable income. Both personal and dependent exemptions lower the amount of your taxable income. That ultimately reduces the amount of total tax you owe for the year.

- For tax purposes, all dependents receive exemptions, including you and your spouse. To the Internal Revenue Service (IRS), these are the people for whom you are financially responsible. A higher number of exemptions reduces your taxable income. In most cases, dependents must be:

- A family member or qualified relative

- Age 18 or below (except for full-time college students under age 24)

- It cannot provide over half of their economic support.

You can reduce your taxable income by multiplying the dollar value of a personal exemption, which is a predetermined amount, by the number of your dependents. For example, in 2017, the personal exemption is $4,050. It’s the same amount for your spouse and each dependent as well. These exemptions are reduced if your adjusted gross income (AGI) exceeds $261,500 as a single filer or 313,800 if you’re married and file a joint return. Example: Josh and Kristen are married with a combined income of $90,000. They have three children whom they claim as dependents. That means they can claim five exemptions of $4,050 each. That reduces their taxable income by $20,250.

You can download tax forms from many places, including the IRS website. Many of those sites don’t help you fill out the forms, however. They also don’t offer a maximum refund guarantee, which is available through TaxAct.

Below is a list of the most common IRS tax forms you may need to file your taxes:

Taxact Federal Tax Forms

- Form 941 — Employer's Quarterly Federal Tax Form

- Form 990 — Return of Organization Exempt From Income Tax

- Form 1040 — Long — Individual Federal Income Tax Return (1040 Instructions)

- Form 1040-A — Middle — Individual Federal Income Tax Return (Note: This form has been eliminated for 2018 tax returns.)

- Form 1040-EZ — Short — Individual Federal Income Tax Return (Note: This form has been eliminated for 2018 tax returns.)

- Form 1040-ES — Estimated Tax for Individuals

- Form 1040-V — IRS Payment Voucher

- Form 1040-X — File Amended Tax Return

- Form 8863 — Education Credits

- Form 8962 — Premium Tax Credits

- Form W-4 — Employee Federal Withholding

- Form W-7 — Individual Taxpayer Identification Number

- Form W-9 — Request Your Tax Information

0 Response to "TaxAct Calculator 2018"

Post a Comment