TaxAct 2018 Download

TaxAct 2018 Download - Tag: TaxAct software download promo code, TaxAct UK, TaxAct USA, TaxAct AUS, TaxAct EU, TaxAct free software download, TaxAct 2018 software download, TaxAct 2017 software download, TaxAct 2019 software download, TaxAct 2020 software download, TaxAct 2021 software download, income tax act software free download, free TaxAct software download, TaxAct software 2018 download, TaxActonline, TaxAct reviews, TaxAct professional, TaxAct 2017, TaxAct software, TaxAct contact, TaxAct online, TaxAct amend Return, TaxAct account, TaxAct audit defense, TaxAct advance, is TaxAct a good program, is TaxAct a legit site, is TaxAct a good website, TaxAct bank, TaxAct bank service fee, TaxAct backdoor Roth, TaxAct business promo code, TaxAct customer service, TaxAct charges, TaxAct discount, TaxAct deluxe, TaxAct download promo code, TaxAct deals, TaxAct download 2019, TaxAct deluxe plus, TaxAct desktop. TaxAct 2018 Download

TaxAct professional edition is nicely ideal for small to mid-sized corporations and tax preparers that cope with an excessive range of 1040 paperwork. Previously geared closer to individuals, TaxAct professional now offers a diffusion of alternatives for each 1040 and commercial enterprise form education and filing. TaxAct is likewise to be had for individuals trying to prepare their personal taxes. TaxAct 2018 Download

TaxAct expert may be mounted on a computing device or pc computers, as well as on a community, where the product may be shared. Customers also can prefer to installation the product as a web community, even though the web choice is simplest available in the business enterprise variations of TaxAct expert. Those the usage of TaxAct experts in earlier years can import information from the previous year or import statistics from every other tax compliance utility.

Once TaxAct professional is hooked up, the Setup Wizard publications users thru the entire method of coming into practice, preparer, customer, and protection information as well as preferred choices. For those installing TaxAct professionals in a neighborhood community, colleagues will need to be invited to apply the software with the intention to advantage get entry to it. Customers can get entry to any patron from the purchaser manager menu and might select to print client organizers for new customers with the purchaser organizer portfolio consisting of a cover sheet, private statistics for every purchaser, in addition to earnings, deduction, and charge information. TaxAct professional additionally consists of TaxTutor, which informs customers about tax regulation changes, and the product offers a What-If situation for preparing numerous tax alternatives for clients.

TaxAct 2018 Download

For companies that only record 1040 bureaucracy, both the 1040 package or the 1040 business enterprise package are suitable alternatives, which include both federal and country 1040 filing, even as those that technique business paperwork will need to look at the alternative bundles, which document 1041, 1065, 1120, the 1120S, and 990 federal forms, and 1041, 1065, 1120, and 1120S kingdom filing for all states.

All TaxAct Bundles consist of limitless e-submitting capability, with all 4 bundles imparting limitless 1040 e-filing functionality, while the entire package and the whole agency package providing both unlimited 1040 re-submitting and unlimited commercial enterprise form e-filing functionality.

TaxAct expert integrates with the non-obligatory purchaser Xchange portal, which allows firms and clients to change documents via the portal from any tool. The patron Xchange helps a vast wide variety of customers and files, and effortlessly handles a diffusion of report types together with Microsoft Excel, Word, and CSV files, PDFs, and receipt images. Users really invite their customers to sign up for the application, with the ability to share files as soon as the consumer is registered.

The expert corporation versions of TaxAct professional include a document manager characteristic that permits users to shop the whole thing from tax bureaucracy and their supporting monetary documents, to notes and different patron correspondence. All files are securely encrypted, and customers can without difficulty access any report thru the record supervisor feature. Elective cloud storage is likewise to be had, so firms can securely store all company facts at the cloud, with smooth access from anywhere with an internet connection.

TaxAct 2018 Download

Accounting corporations can now associate with ProAdvance from TaxAct, which gives get entry to a selection of 0.33-party enterprise resources designed mainly for the expert accounting workplace. Those assets include payment reputation solutions, financial and wealth management services, audit and identification robbery assistance, patron payroll options, exercise control capability, and small business lending options. TaxAct expert additionally offers a strengthen refund option for firm customers, with underwriting provided by means of Republic bank and accept as true with. At this time, TaxAct professional does now not provide integration with any tax research packages.

TaxAct professional gives strong gadget help, with users capable of getting entry to the assist page from anywhere inside the utility. Aid options consist of a Getting started function, a Setup manual, and get admission to all help subjects. The help feature is completely searchable, so users can just enter a seek term or word to get entry to help for that particular topic. Each product and tax support alternatives are to be had thru cellphone or e-mail, with prolonged assistance available during tax season. All product support is covered in the cost of the software program. TaxAct 2018 Download

TaxAct Professional is an outstanding match for smaller companies that process a high range of 1040 returns for clients. TaxAct expert is available via numerous bundles: the 1040 package deal, which is $600 in line with the year for one user; the 1040 organization package deal, that is $675 for limitless users; the whole bundle for $1, a hundred twenty-five for one consumer, which gives commercial enterprise returns in addition to 1040 shape processing; and the whole agency bundle, for any range of users for $1,450 consistent with year. All TaxAct Bundles provide limitless e-filing capability, and the enterprise versions of TaxAct professional include cloud garage alternatives, information backup, and record manager capability. The customer Xchange module is also available at an additional fee. Pay-according to-return versions are to be had for lower quantity customers

Taxact Software Benefits:

- Multiple import options to save time, Transfer vital personal data from last year's tax return, including information required for IRS e-file. Plus, minimize errors by importing charitable donations, stocks, W-2s, and more!

- All the free support you need, Never get stumped by a tax question. Search for the fastest answers in the Answer Center, or contact us for free tax & technical support when you need it.

- Reduce your audit risk with TaxAct Alerts, TaxAct inspects your return for errors and omissions that could increase your risk of an audit, and finds valuable tax-saving opportunities you may have missed.

- Turn your donations into tax savings, Donation Assistant® tracks your charitable donations and provides audit-backed values to eliminate guesswork and maximize your tax deduction.

- Finds all your credits & deductions, Maximize your deductions and minimize your taxes with TaxAct Deluxe. All the forms & features you need are included so you get your guaranteed maximum refund.

- Perfect for your unique situation, Get the biggest tax breaks from your mortgage interest, investments and more. If you own a home, have investments, or made charitable donations, TaxAct Deluxe has the forms and tools for your specific tax situation.

- Free Amended Tax Returns, Need to amend your IRS return? File Form 1040X at any time - no upsells or upgrades required.

- Finish your state return in minutes, Your federal information automatically flows into your state tax forms so you can finish and file your state return in minutes!

- Step-by-step guidance for maximum refund, Your return is guaranteed 100% accurate, and you'll get your maximum refund the fastest way possible with e-file.

- Bookmarks, Navigate your return on your terms. Simply Bookmark a question to return to it at any time.

- My Forms, Get a personalized view of the forms and schedules included in your return. Easily add copies of needed documents and view your in-progress forms.

Read More: TaxAct Deluxe Edition

Taxact Software Forms:

- Form 1040:US Individual Income Tax Return, Form 1040ES: Estimated Tax Payments, Form 1040-V: Payment Voucher, Form 1040X: Amended US Individual Income Tax Return, Form 1045:Application for Tentative Refund, Form 1127:Application for Extension of Time for Payment of Tax Due to Undue Hardship, Form 1310:Refund Due a Deceased Taxpayer, Form 14039:Identity Theft Affidavit, Form 2120:Multiple Support Declaration, Form 2848:Power of Attorney and Declaration of Representative, Form 4868:Application for Automatic Extension of Time to File U.S. Individual Income Tax Return,

- Form 8332 Release/Revocation of Release of Claim exemption, Form 8606 Nondeductible IRAs, Form 8615 Tax For Certain Children Who Have UnearnedIncome, Form 8815 Exclusion of Interest From Series EE & I U.S.Savings Bonds Issued After 198, Form 8822 Change of Address, Form 8862 Information to Claim Earned Income Credit AfterDisallowance, Form 8863 Education Credits, Form 8888 Allocation of Refund (Including Bond Purchases), Form 8915A Qualified 2016 Disaster Retirement PlanDistributions and Repayments, Form 8915B Qualified 2017 Disaster Retirement PlanDistributions and Repayments, Form 9465 Installment Agreement Request, Form W-7 Application for IRS Individual TaxpayerIdentification Number, Schedule 8812 Additional Child Tax Credit, Schedule EIC Earned Income Credit, Schedule R Credit for the Elderly or the Disabled, Form 1040NR US Nonresident Alien Income Tax Return,

- Form 1040NR-EZ US Income Tax Return for CertainNonresident Aliens With No Dependents, Form 1040SS US Self Employment Income Tax Return, Form 1116 Foreign Tax Credit, Form 2106 Employee Business Expenses, Form 2210 Underpayment of Estimated Tax by Individuals, Form 2210F Underpayment of Estimated Tax by Farmers and Fisherman, Form 2441 Child and Dependent Care Expenses, Form 2555 Foreign Earned Income, Form 3115 Application for Change in Accounting Method, Form 3468 Investment Credit, Form 3800 General Business Credit, Form 3903 Moving Expenses, Form 4136 Credit for Tax Paid on Fuels, Form 4137 Tax on Unreported Tip Income, Form 4562 Depreciation and Amortization, Form 4563 Exclusion of Income for Bona Fide Residents of American Samoa, Form 4684 Casualties and Thefts, Form 4797 Sales of Business Property, Form 4835 Farm Rental Income and Expenses, Form 4952 Investment Interest Expense, Form 4972 Tax on Lump-Sum Distributions,

- Form 5074 Allocation of Individual Income Tax to Guam or the Commonwealth of the Northern Mariana Islands (CNMI), Form 5329 Additional Taxes on Qualified Plans, Form 5405 Repayment of the First-Time Homebuyer Credit, Form 5471 Information Return of U.S. Persons with Respect to Certain Foreign Corporations, Form 5695 Residential Energy Credits, Form 5884 Work Opportunity Credit, Form 5884-A Credits for Affected Disaster Area Employers, Form 6198 At-Risk Limitations, Form 6251 Alternative Minimum Tax, Form 6252 Installment Sale Income, Form 6478 Biofuel Producer Credit, Form 6765 Credit for Increasing Research Activities, Form 6781 Gains and Losses from Section 1256 Contracts and Straddles, Form 8283 Noncash Charitable Contributions, Form 8379 Injured Spouse Allocation, Form 8396 Mortgage Interest Credit, Form 8582 Passive Activity Loss Limitations, Form 8582-CR Passive Activity Credit Limitations, Form 8586 Low-Income Housing Credit, Form 8594 Asset Acquisition Statement,

- Form 8609 Low-Income Housing Credit Allocation and certification, Form 8609-A Annual Statement for Low-Income Housing Credit, Form 8621 Return by a Shareholder of a Passive ForeignInvestment Company or Qualified Electing Fund, Form 8689 Allocation of Individual Income Tax to the U.S.Virgin Islands, Form 8801 Credit for Prior Year Minimum Tax, Form 8814 Parents' Election to Report Child's Interest and Dividends, Form 8820 Orphan Drug Credit, Form 8824 Like-Kind Exchanges, Form 8826 Disabled Access Credit, Form 8828 Recapture of Federal Mortgage Subsidy, Form 8829 Expenses for Business Use of Your Home, Form 8833 Treaty-Based Return Position Disclosure UnderSection 6114 or 7701(b),

- Form 8835 Renewable Electricity, Refined Coal, and IndianCoal Production Credit, Form 8839 Qualified Adoption Expenses, Form 8840 Closer Connection Exception Statement for aliens, Form 8843 Statement for Exempt Individuals and Individuals With a Medical Condition, Form 8844 Empowerment Zone Employment Credit, Form 8845 Indian Employment Credit, Form 8846 Credit for Employer Social Security and Medicare Taxes Paid on Certain Employee Tips, Form 8853 Archer MSAs and LTC Insurance Contracts, Form 8864 Biodiesel and Renewable Diesel Fuels Credit, Form 8874 New Markets Credit,

- Form 8880 Credit for Qualified Retirement SavingsContributions, Form 8881 Credit for Small Employer Pension Plan StartupCosts, Form 8882 Credit for Employer-Provided ChildcareFacilities and Services, Form 8885 Health Coverage Tax Credit, Form 8889 Health Savings Accounts, Form 8896 Low Sulfur Diesel Fuel Production Credit, Form 8900 Qualified Railroad Track Maintenance Credit, Form 8903 Domestic Production Activities Deduction, Form 8906 Distilled Spirits Credit, Form 8908 Energy Efficient Home Credit, Form 8910 Alternative Motor Vehicle Credit, Form 8911 Alternative Fuel Vehicle Refueling PropertyCredit, Form 8917 Tuition, and Fees Deduction,

- Form 8919 Uncollected Social Security and Medicare Tax on Wages, Form 8923 Mine Rescue Team Training Credit, Form 8932 Credit for Employer Differential Wage Payments, Form 8933 Carbon Dioxide Sequestration Credit, Form 8936 Qualified Plug-in Electric Drive Motor VehicleCredit, Form 8938 Statement of Specified Foreign Financial Assets, Form 8941 Credit for Small Employer Health insurance premiums, Form 8949 Sales and other Dispositions of Capital Assets,

- Form 8958 Allocation of Tax Amounts Between CertainIndividuals in Community Property States, Form 8959 Additional Medicare Tax, Form 8960 Net Investment Income Tax, Form 8962 Premium Tax Credit (PTC), Form 8995 Qualified Business Income Deduction SimplifiedComputation, Form 8995-A Qualified Business Income Deduction, Form 8997 Initial and Annual Statement of QualifiedOpportunity Fund (QOF) Investments, Form 965 Inclusion of Deferred Foreign Income, Form 982 Reduction of Tax Attributes Due to Discharge ofIndebtness,

- Schedule 1 (Form 1040) Additional Income and Adjustments income, Schedule 2 (Form 1040) Tax, Schedule 3 (Form 1040) Nonrefundable Credits, Schedule A Itemized Deductions, Schedule H Household Employment Taxes, Schedule J Income Averaging for Farmers and Fisherman, Schedule SE Self-Employment Tax, Form 461 Limitation on Business Losses, Schedule B Interest and Ordinary Dividends, Schedule D Capital Gains and Losses, Schedule E Supplemental Income and Loss, Schedule C Profit or Loss From Business, Schedule F Profit or Loss From Far.

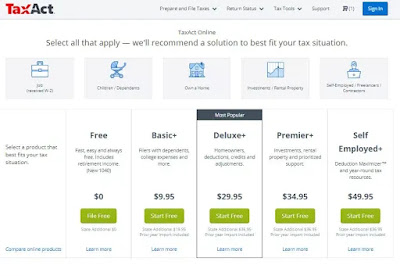

TaxAct Online vs. TaxAct Desktop (Download)

- TaxAct® has two different types of products that allow you to prepare, print and e-file your tax return; TaxAct Online and TaxAct Download.

- With TaxAct Online, you create an online account and prepare your taxes using a web browser. Your return is saved on our secure servers and you may login to your account from any computer with an internet connection. Each TaxAct Online account can prepare one return.

- TaxAct Download is software you download and install on your personal computer. Just like any other software, you will save your tax return to your computer, flash drive, etc. The file can only be opened if you have TaxAct software installed on your computer. TaxAct Desktop allows you to prepare and print multiple tax returns, making it perfect for households with multiple taxpayers.

Downloading and Installing TaxAct.

Want a demonstration? Take a look at our How to Download & Install TaxAct Professional Editions video.

Once you receive your order confirmation and know your Username and Password, follow these instructions to download and install your TaxAct Professional and/or Desktop Editions.

Note - You can re-download and install any previously purchased software (back to 2011) at no additional charge by following these same instructions.

- Sign In to your TaxAct account.

- Click the Orders and Downloads tile.

- Click the Download link by the product you wish to download. If multiple products are available, click the View link to access the individual Download links.

- Save the file to a location you will have access to such as "Downloads," "My Documents" or "Desktop."*

- Once downloaded, double-click on the file icon to install the software.

* If you are using Windows SmartScreen, we recommend using the default Windows "Downloads" folder if you are getting a corrupt or invalid download error. Download times vary depending on your Internet connection and how much traffic is on the website.

Taxact Software requirements:

Requirements For Windows Version:

Windows 10: Chrome Latest Version, Firefox Latest Version, Internet Explorer 11, Microsoft Edge.

Windows 8.1: Chrome Latest Version, Firefox Latest Version, Internet Explorer 11.

After January 14, 2020, Microsoft will no longer provide security updates or support for PCs running Windows 7. For the best experience and security of your data, you will need to update your system to Windows 8.1 or 10. Link Download

TaxAct 2018 Deluxe Edition Download

TaxAct 2018 Basic Edition Download

0 Response to "TaxAct 2018 Download"

Post a Comment