TaxAct 2019 Free Download

TaxAct 2019 Free Download - Tag: TaxAct Calculator 2018, income tax act 2019 pdf free download, UK income tax act 2019 pdf free download, TaxAct software download promo code, TaxAct UK, TaxAct USA, TaxAct AUS, TaxAct EU, TaxAct free software download, TaxAct 2018 software download, TaxAct 2017 software download, TaxAct 2019 software download, TaxAct 2020 software download, TaxAct 2021 software download, income tax act software free download, free TaxAct software download, TaxAct software 2018 download, TaxActonline, TaxAct reviews, TaxAct professional, TaxAct 2017, TaxAct software, TaxAct contact, TaxAct online, TaxAct amend Return, TaxAct account, TaxAct audit defense, TaxAct advance, is TaxAct a good program, is TaxAct a legit site, is TaxAct a good website, TaxAct bank, TaxAct bank service fee, TaxAct backdoor Roth, TaxAct business promo code, TaxAct customer service, TaxAct charges, TaxAct discount, TaxAct deluxe, TaxAct download promo code, TaxAct deals, TaxAct download 2019, TaxAct deluxe plus, TaxAct desktop. TaxAct 2019 Free Download

TaxAct might be a perfect fit for somebody who's looking for a straightforward, spending plan cordial expense documenting choice on the web, with the additional comfort of a versatile application and live talk for direction, tips, and deceives. TaxAct gives charge readiness programming that is intended to fit an assortment of documenting needs, extending from purchasers who are searching for an approach to record a basic government return for nothing to independently employed entrepreneurs, consultants, and contractual workers who need to augment each finding. There are five recording items accessible for buyers, however, for testing purposes, we utilized the online Deluxe+ adaptation, which TaxAct touts as its most mainstream alternative. Jump into our survey to become familiar with the highlights, evaluating, backing, and convenience to assist you with choosing if TaxAct is the correct assessment documenting programming for you. TaxAct 2019 Free Download

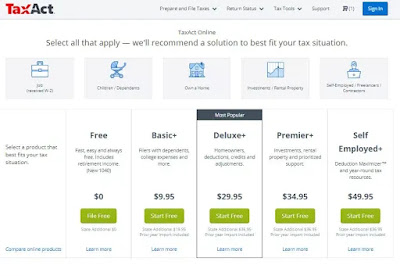

As referenced before, TaxAct offers five web-based recording items for customers. The accompanying table features one, alongside its valuing and the extra rate for documenting state returns.

TaxAct additionally offers a downloadable programming variant for purchaser assessment forms. The downloadable rendition is appropriate for family units that need to document various returns for various citizens. Free documenting isn't a choice yet there are four different projects to browse:

Pricewise, TaxAct's internet recording renditions are simpler on the wallet contrasted with other duty documenting programs. For instance, a mortgage holder would pay $29.95 for the Deluxe+ form with TaxAct while a portion of its rivals charges $49.99 or $59.99 for a similar level item.

One incredible thing TaxAct offers that a portion of the other assessment prep programming organizations doesn't is a Price Lock Guarantee. It's truly straightforward: the value you lock in at the time you pick which programming system to utilize is a similar value you pay when you really record.

TaxAct 2019 Free Download

So on the off chance that you start your Deluxe+ return in February yet don't record your arrival until May, the cost won't change. One thing to know, however. You just get this advantage with TaxAct's online programming items.

There are some expensive programs out there that accompany heaps of additional items. For instance, you may discover a program that incorporates with TurboTax's ItsDeductible application so you can without much of a stretch include deductible costs. There are additional programs that coordinate with salary and cost following applications to make charge recording simpler for specialists and self-employed entities.

TaxAct 2019 Free Download

TaxAct, sadly, doesn't accompany those sorts of additional items. It truly is a no-nonsense recording programming that is intended to assist you with setting up your arrival. TaxAct 2019 Free Download

That is acceptable in the event that you need a basic and simple to-utilize program but on the other hand, it's a disadvantage since one thing you can't do with the online variant is import W-2s. That is something a significant number of TaxAct's rivals incorporate with their product programs. In the event that you need to have the option to import W-2s, you'll have to jump on one of the downloadable TaxAct forms.

Taxact Software Benefits:

- Multiple import options to save time, Transfer vital personal data from last year's tax return, including information required for IRS e-file. Plus, minimize errors by importing charitable donations, stocks, W-2s, and more!

- All the free support you need, Never get stumped by a tax question. Search for the fastest answers in the Answer Center, or contact us for free tax & technical support when you need it.

- Reduce your audit risk with TaxAct Alerts, TaxAct inspects your return for errors and omissions that could increase your risk of an audit, and finds valuable tax-saving opportunities you may have missed.

- Turn your donations into tax savings, Donation Assistant® tracks your charitable donations and provides audit-backed values to eliminate guesswork and maximize your tax deduction.

- Finds all your credits & deductions, Maximize your deductions and minimize your taxes with TaxAct Deluxe. All the forms & features you need are included so you get your guaranteed maximum refund.

- Perfect for your unique situation, Get the biggest tax breaks from your mortgage interest, investments and more. If you own a home, have investments, or made charitable donations, TaxAct Deluxe has the forms and tools for your specific tax situation.

- Free Amended Tax Returns, Need to amend your IRS return? File Form 1040X at any time - no upsells or upgrades required.

- Finish your state return in minutes, Your federal information automatically flows into your state tax forms so you can finish and file your state return in minutes!

- Step-by-step guidance for maximum refund, Your return is guaranteed 100% accurate, and you'll get your maximum refund the fastest way possible with e-file.

- Bookmarks, Navigate your return on your terms. Simply Bookmark a question to return to it at any time.

- My Forms, Get a personalized view of the forms and schedules included in your return. Easily add copies of needed documents and view your in-progress forms.

Read More: TaxAct Deluxe Edition

Taxact Software Forms:

TaxAct Tax Calculator

This tool provides you with an advanced look at your income tax return before you actually sit down and go about the business of preparing it. It provides several screens where you input your tax information, and get a realistic estimate of your tax liability or refund. You can think of it as a dry run before the real filing.

TaxAct Tax Bracket Calculator

This tool enables you to determine in advance what tax bracket you’ll be in. It provides a full chart of the tax rates in all income brackets for single filers, married filing jointly or qualifying widower, married filing separately, or head of household.

The weakness in this tool is that it requires you to come up with your taxable income before making a determination. But you can do that using the tax calculator, which will also show you your estimated tax liability, which might make the tax bracket unnecessary—unless you’re just curious.

TaxAct Self-Employment Tax Calculator

If you’re self-employed, you’ll be responsible for paying the self-employment tax. That’s the FICA tax for business owners. Since that tax is 15.3 percent of your net business income, it might be higher than your actual federal tax rate.

It will help to know what this tax will be before preparing your tax return. You can find out with the Self-Employment Tax Calculator. By imputing your estimated net self-employment income into the calculator, you can get an estimate of what the self-employment tax will be.

TaxAct Online vs. TaxAct Desktop (Download)

- TaxAct® has two different types of products that allow you to prepare, print and e-file your tax return; TaxAct Online and TaxAct Download.

- With TaxAct Online, you create an online account and prepare your taxes using a web browser. Your return is saved on our secure servers and you may login to your account from any computer with an internet connection. Each TaxAct Online account can prepare one return.

- TaxAct Download is software you download and install on your personal computer. Just like any other software, you will save your tax return to your computer, flash drive, etc. The file can only be opened if you have TaxAct software installed on your computer. TaxAct Desktop allows you to prepare and print multiple tax returns, making it perfect for households with multiple taxpayers.

Downloading and Installing TaxAct.

Want a demonstration? Take a look at our How to Download & Install TaxAct Professional Editions video.

Once you receive your order confirmation and know your Username and Password, follow these instructions to download and install your TaxAct Professional and/or Desktop Editions.

Note - You can re-download and install any previously purchased software (back to 2011) at no additional charge by following these same instructions.

- Sign In to your TaxAct account.

- Click the Orders and Downloads tile.

- Click the Download link by the product you wish to download. If multiple products are available, click the View link to access the individual Download links.

- Save the file to a location you will have access to such as "Downloads," "My Documents" or "Desktop."*

- Once downloaded, double-click on the file icon to install the software.

* If you are using Windows SmartScreen, we recommend using the default Windows "Downloads" folder if you are getting a corrupt or invalid download error. Download times vary depending on your Internet connection and how much traffic is on the website.

Taxact Software requirements:

Requirements For Windows Version:

Windows 10: Chrome Latest Version, Firefox Latest Version, Internet Explorer 11, Microsoft Edge.

Windows 8.1: Chrome Latest Version, Firefox Latest Version, Internet Explorer 11.

After January 14, 2020, Microsoft will no longer provide security updates or support for PCs running Windows 7. For the best experience and security of your data, you will need to update your system to Windows 8.1 or 10. Link Download

0 Response to "TaxAct 2019 Free Download"

Post a Comment